Supply-Chain Financing

Supply Chain Financing gives added liquidity to buyers.

When buyers demand longer repayment terms, i.e., 120, 180, 360 days, sellers can run into a cash-crunch or simply do not want to take on the risk waiting to be repaid.

There are many structures of supply chain financing, reverse factoring and trade payable financing. For example, supply chain financing companies typically pay those sellers now, with the buyer repaying the financing company at a later date.

After the initial receivable has been extinguished, a debt instrument like, a promissory note, is created in its stead.

Supply Chain Financing optimizes cash flow by allowing businesses to lengthen their payment terms to their suppliers while still allowing a way for the suppliers to get paid early. There are many different ways these are structured. Below are two common examples.

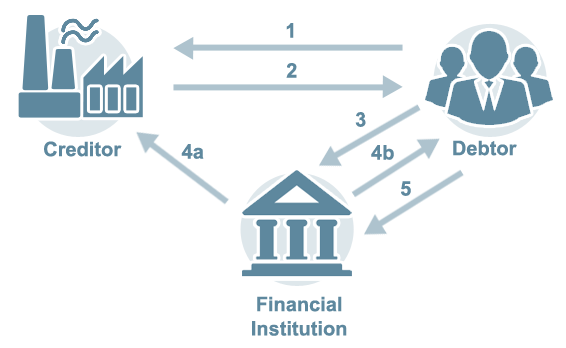

Supply Chain Financing – Promissory Note/Rescheduling of Debt

Financial Institution Reschedules Debt, Creates Promissory Note

Credit Insurance Policy Protects Promissory Note

A Promissory Note is a signed document with a written promise to pay a stated sum to a specified party at a specified date; in this type of transaction, the promissory note has a due date that is later than what is specified in the purchase order.

This type of financing provides extended terms to the debtor, freeing up cashflow, while the creditor gets paid within standard terms.

- Debtor sends PO to Creditor

Standard terms of sale (example: net 30) - Creditor ships goods and invoices

Standard terms of sale (example: net 30) - Debtor presents payable to Financial Institution

- a. Financial Institution pays creditor within terms (net 30)

b. Financial Institution sends promissory note to debtor with later due date (example: net 120) - Debtor pays financial institution on later (120th) date

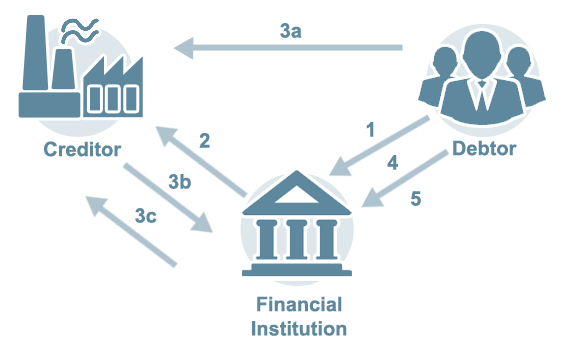

Supply Chain Financing – Financial Institution Acts as Intermediary

Financial Institution controls flow of documents and payments

Credit Insurance Policy Protects invoice from financial institution to debtor

This type of financing accords the financial institution with more control over the process, while providing extended terms to the debtor, freeing up cashflow, while the creditor gets paid within standard terms.

- Debtor notifies Financial Institution to place order

- Financial institution issues purchase order on discount terms (example: 1% 10 days/net 30 days) with instructions to ship to debtor

- a: Creditor ships to debtor as per financial institution’s purchase order

b: Creditor issues invoice (example: 1% 10 days/net 30 days)

c: Financial institution pays creditor, takes discount

- Financial institution invoices debtor on extended terms (example: net 120 days)

- Debtor pays financial institution on extended due date (120th day)

Contact a Professional

Want to speak to a professional about your Credit Insurance needs?

Latest Articles

Borrowing Calculator

See how much more you can borrow by having Credit Insurance.